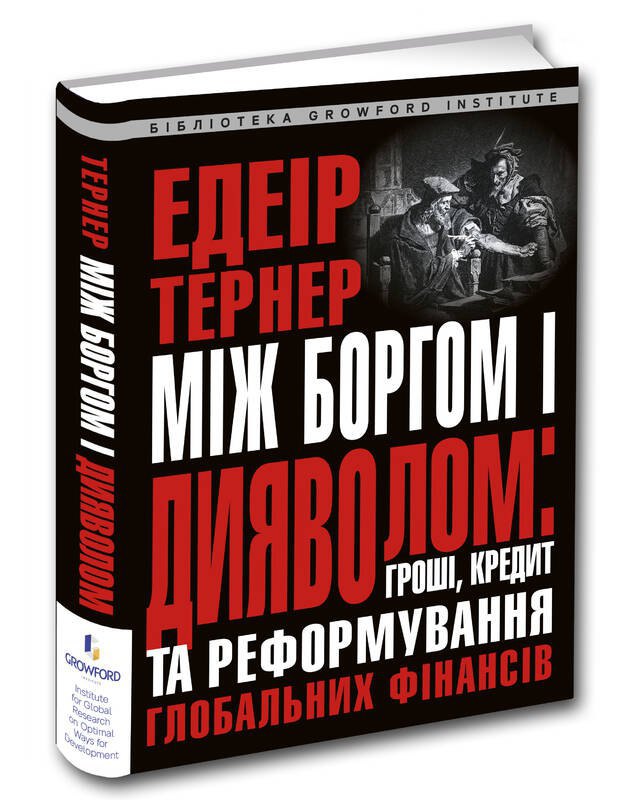

It's a great pleasure to have my book “Between Debt and the Devil” now translated into Ukrainian, and I would like to thank Mr. Lomakovich for the initiative in doing that.

I would like now to describe some key features of the arguments I put forward in the book, and at the end I will try to think about how that might relate to the current Ukrainian experience, though I am very aware that I'm not at all an expert in the macroeconomic or microeconomic challenges you face there.

On the Origins of the 2008 Financial Crisis

The initial trigger for writing the book was the global financial crisis of 2008 – an experience for me, which was both very challenging and very exciting, and for a time quite frightening.

I became the Chair of the UK Financial Services Authority on September the 20th, 2008 which was precisely five days after the collapse of Lehman Brothers. The entire global financial system was in a process of collapse. I have sometimes described it as feeling like being appointed captain of the Titanic ship after you've hit the iceberg but before you've sunk. Because it certainly felt like the global financial system was about to sink, at that stage.

So, part of my initial motivation of writing the book, once we had got through the immediate crisis, was to reflect on the causes of the crisis of 2008. And many of those causes were internal to the financial system itself, though rooted in what I believe were incredibly simplistic and misleading economic theories.

Ahead of the crisis, there was a very strong theory rooted in neoclassical economics, that complete liberalization of financial markets was bound to create greater economic efficiency. So, if you look at the writings of many economists and indeed of experts at the IMF in the eight years or so before 2008, you will see lots of descriptions of why the new model of a financial intermediation with origination and distribution away from bank balance sheets, the development of shadow banking, the use of derivatives and sophisticated Value-at-Risk models were bound to make the financial system a more efficient system for allocating capital through to investment needs.

And what I realized was that most of that theory was profoundly wrong and that the proliferation of trading activities of derivatives, of complicated ways of originating credit and then distributing it through multiple chains of intermediation far from making the financial system safer had made it much more unstable.

And so, part of the book, and in particular chapters One and Two, are about those mistaken theories of financial liberalization and what was wrong with that.

A lot of my life from 2008 to 2013 was engaged in the process of re-regulation at a global level to create a more stable financial system which would not suffer an internally generated crisis like 2008. Those reforms included tighter controls on trading activity, on derivatives, much larger capital ratios required in banks. And I think those helped create what is today a much more stable financial system than existed before 2008.

So, I do not anticipate that we will suffer anytime soon a financial crisis within the guts of the global financial system anything like what occurred in 2008.

But as we moved out of the immediate crisis of 2008 and created a more stable financial system, it became apparent to me that beyond the details of the system, there were some more fundamental macroeconomic challenges facing the global economy which lay behind the financial crisis of 2008 and, in particular, the very slow recovery after it.

Those macroeconomic – rather than purely financial – issues related to the fundamental nature of money and credit creation and debt. And to address them, I found that I had to return to some basics of economic theory about the nature of money and credit, which had also been largely ignored in pre-crisis neoclassical economics.

One of the key factors which I note in the book, is the extraordinary increase in the amount of debt, specifically of private debt, which occurred between, for instance, 1950 and 2007, on the eve of the crisis. As set out in Carmen Reinhart and Kenneth Rogoff’s book, on this time it's a different eight centuries of financial folly. They describe the way that private credit as a percent of GDP in the advanced economies grew from 50% of GDP in 1950 to 170% by 2007.

And work by economists such as Alan Taylor and Òscar Jordà has identified that almost all of this credit growth was not extended to finance new capital investment in the productive economy but to the purchase of real estate and primarily real estate that already existed, with the value of real estate continuing to increase and in particular the value of land

A very large part of the role of a banking system in advanced economies is not the role described by our economic textbooks of “taking savings and putting them into productive investment”. It is about lubricating a competition between individuals and companies for the ownership of scarce real estate. To a surprising extent, that is what it does. So, there was this very large buildup of debt which is somewhat detached from the process of productive investment in the real economy and that buildup of private debt along with the specific features of the financial system itself helped to create the crisis of 2008. But even more importantly, it helped to create the difficult situation I which we found ourselves after the crisis – the situation which in chapters Three, Four, and Five of the book I describe as the debt hangover or the debt overhang.

Once you have created a very large amount of private debt secured against real estate in an economy, and if you have a financial crisis, you can enter an environment in which the private sector is determined to save money to pay down that debt. And the attempt of the private sector to do that pushes the economy into a deflationary depression in which there is inadequate demand. And that is what happened after 2008. What is interesting macroeconomically, and what I describe in chapters Three, Four, and Five, is that in that environment monetary policy becomes ineffective because interest rates fall to the zero, to what central banks call the zero-lower bound, and they are no longer effective at stimulating demand. Short-term policy interest rates were cut to zero. Long-term rates fell to zero and were pushed down even more by quantitative easing.

But if interest rates are already very low, the impact of additional capital interest rates within the economy is very limited. And in that environment, it turns out that the only thing which will keep the global economy going and the advanced economy going is large public deficits.

On Public Deficit as a Tool of Getting Out of Crisis, and Japan’s Experience of the 90’s

At the London G20 meeting in April 2009, it was agreed that the major advanced economies must run large fiscal deficits to keep the economy going. But what then happened is that after a while, as countries began to run those large fiscal deficits, they began to worry about the fact that public debt was now increasing. Private debt began to go down but public debt went up and then there were attempts with austerity to offset those.

What this produced, was a period in the mid 2010’s of very slow growth and inflation below target in the advanced economies which was part of the background to the rise of populism with this slow growth period.

When I wrote the book in 2015 and 2016, what I was very aware of in the advanced economies – within the Eurozone, within the UK, within Japan, and the US – was a real challenge for a macroeconomic policy. It seemed to be impossible to keep the economies going with sufficiently rapid growth in nominal demand even to hit the inflation targets which governments had set, such as at two percent. There was a fundamental problem of how do you create aggregate monetary demand, nominal demand in a situation where there is a large private debt overhang and where interest rates have reached a zero bound.

What I and others therefore ended up believing, was that the Eurozone the UK and the US had entered a situation similar to what Japan had entered after the 1990s. In that situation, large fiscal deficits and quantitative easing were a permanent feature of life.

Before 1990, Japan faced an explosion of private debt to finance an extraordinary real estate boom. It then entered this process of debt overhang in the 1990’s and ever since then it has to run large public deficits because the private sector of the economy – corporate and personal together – runs large surpluses. The government side therefore has to run large deficits to make a macro demand balance and to finance the central bank purchases of government debt in large quantities.

The Bank of Japan now owns a government debt equal to 100% of GDP.

And in the final chapters of “Between Debt and the Devil” I argued that this would almost certainly in Japan turn out to be permanent monetary finance. That we would never see this debt sold back to the private sector. That it was essentially the central bank keeping the economy going in an environment where interest rates were ineffective keeping it going by permanently funding large deficits.

So, in 2015 and 2016 when I wrote the book, what I was fascinated by was in already advanced economies with low inflation and inflation below target. How do you keep the economy going in an environment where monetary policy is ineffective?

And I somewhat broke a central banks’ and orthodox economists’ taboo by arguing that in those specific circumstances you could not avoid the possibility of permanently running large fiscal deficits which were permanently financed by central bank money, and that in those specific circumstances that would need not lead to hyperinflation but, indeed, would be required to keep inflation even at the low two percent targets which central banks and governments had set.

But while I was focused in the book on that conundrum of what do you do when you face this large debt overhang, I also became increasingly convinced that the causes of slow nominal demand growth and very low interest rates might be even more fundamental. I therefore became interested and I mentioned this in the book.

On the Theory of Secular Stagnation

If I was to rewrite my book now, I would focus even more on the theory of secular stagnation which people like Lawrence Summers, the former Treasury Secretary of the US, and other economists have put forward.

For instance, in a recent paper by L. Summers and Jason Furman on a reconsideration of fiscal policy, they have argued that the advanced economies have entered an environment where the naturally arising balance of attempted private savings and desired private investment is such as to produce an environment of a permanent lack of adequate demand and permanently low interest rates.

Those experts, like me, have noticed that if you look not at short-term interest rates but at long-term real interest rates in the Eurozone, in the UK, in the US, in Japan, they have been relentlessly falling from about four percent back in the 1980’s to zero or negative today.

And when in economics we see that sort of really long-term pattern – a fall over 30 years of a long-term real interest rates – I think we have to search for real determinants of that rather than determinants rooted in central bank policy or short-term nominal phenomena.

The explanation which has been put forward by some very good papers by the Bank of England and by work by Larry Summers and others is that there has been a change in the balance of ex-ante savings in the world and post-ante attempted investment with high savings created by inequality, by structural imperfections in East Asian economies but it's low investment created by the fact that on the investment side of the economy the cost of capital goods which are information and technology intensive keeps on falling; and that this creates an environment where the whole world of the advanced economies may look for many decades like Japan looks – an environment where there is more attempted savings than investment on the private side of the economy, and therefore, where we may have permanent public deficits.

Whereas those public deficits may need to be, to some extent, financed by permanent quantitative easing operations which are never reversed, I personally believe that it is highly likely that in the advanced economies we have entered not just a few more years but possibly several decades in which real long-term interest rates will continue to be very low or even negative, in which we will see large government deficits run for many years, and quantitative easing operations which are never reversed.

The question for Ukraine – What to Do?

What are the implications of this for a country which is not as rich as Japan or the Eurozone and also which is mid-sized rather than continental-sized? Ukraine is not as big as the Eurozone, Japan or the US and in the recent past has had a history of radical monetary instability and very high inflation rates. I think, that it is important to realize – and it's unfortunate but it is a fact – that the degrees of freedom available to a mid-sized country with that history are different from those available to the US, Japan or to the Eurozone.

I think, I'd like to make two points about the situation facing a country like Ukraine, attempting to grow its economy and to grow GDP per capita. Of course, it's in a different position from classic developing economies because in the past? at stages, it has been quite towards the forefront of technology and development. But it’s suffered some setbacks and now wants to grow its GDP per capita again. So, it's in a different position from Korea or Japan back in their growth periods of the 60’s and the 70’s. It's a different development challenge but it is a development challenge.

I'd like to make some points about the micro economy of development and the macro economy of a situation of a mid-sized economy.

On the macro micro economy, the relevant chapters of my book are chapters Seven and Eight where I talk about the ways in which countries like Japan and Korea, and more recently China, achieved rapid economic growth and technological advance. It’s interesting that in the rapid growth phases all of them did not follow pure neoclassical, neoliberal patterns of completely free market approaches to the allocation of capital. To different extents, all of them have directed or encouraged their banking systems to invest in what they perceived as the most productive forms of innovation and technology for the future.

In the case of Japan and Korea, in their periods of most rapid growth, they discouraged the banking systems from investing in real estate. China, by contrast, faces a problem of far too much investment in real estate with the central bank and the regulator continually trying to constrain that but finding it difficult.

The key point I make in chapters Seven and Eight, is that processes of rapid development have very rarely involved a completely free market approach to the process of capital allocation through the banking system and credit creation. They have involved some sort of mechanism for the finance ministry, the regulator, or the central bank to try to encourage the forms of credit creation and credit extension which will drive a productive investment rather than real estate speculation. And it is therefore interesting to think about what might be the lessons of that for Ukraine about whether you can have a purely free market approach or whether you also need to use those degrees of a direction and encouragement which we have seen in other successful rapid growth countries.

The second point is macroeconomy.

What is interesting about some periods of rapid growth in Korea or Japan, is that they have not been associated with very low rates of inflation. They've typically been associated not with hyperinflation but with six, seven, ten percent inflation growth rates rather than very low inflation rates. And they have sometimes been associated by macroeconomic forms of roles of the central banks which have to a degree broken the rules against monetary finance which we now impose. For instance, central bank being willing to refinance a private bank’s extension of credit in a way which you don't so much see central banks do today, or in some cases directly funding the government to fund a productive investment.

Now of course, the moment one says that, people say “yes”. But the trouble is that such an approach will lead to hyperinflation. The fundamental challenge of this issue is that on some circumstances it does that, although I have argued that monetary finance within carefully defined limits can play a role in the macroeconomy.

I also have to accept that there are other environments where the very fact that we admit that monetary finance is possible, leads to such complete in discipline that we have hyperinflation. And here, I think, is the challenge for a mid-sized economy with a history of hyperinflation.

I believe that Japan can run large fiscal deficits almost forever and can use what I think will turn out to be permanent monetary finance to finance part of that. I think the central bank will continue to buy government bonds and those will never be sold back to the private sector.

But if I visited Argentina, I would tell them to be incredibly careful of doing that or of suggesting to the external market that they are doing that. Because I think, in Argentina’s case any suggestion that they were doing monetary finance would produce movements in the exchange rate which would create inflation, which would create inflationary expectations, which would lead to all of that stimulus to nominal demand turning up in inflation rather than in real economic stimulation.

So, what is the difference between Japan and Argentina?

Well, the difference is that Japan’s process of funding its very large deficits depends on large savings rates within the economy rather than on external finance. And so, there is a difference between countries which have large fiscal deficits primarily financed internally, and those which have large elements of external finance.

But there is also a history and reputation issue. It is simply the fact that because Japan for the last 30 years has had inflation which is incredibly low or negative, people expect its inflation to be incredibly low or negative. So, when the central bank does large permanent quantitative ease operations, nobody turns that into an inflationary expectation which drives a depreciation of the exchange rate, which drives more inflation.

Whereas, when they face Argentina, they have a completely different set of expectations.

So, it is a simple fact that the degrees of freedom available for finance ministries and central banks to use some of these unconventional mechanisms of supporting investment in growth are much wider for either a Japan or the USA, which runs the reserve currency of the US dollar, than they are for a mid-sized country with a history of hyperinflation.

I don't think that means that the degrees of freedom are null and I hope that my book helps think through some of the ways that Ukraine might use regulation of the banking system and the interface between the central bank and the finance ministry to support a productive investment in the real economy.

But given that Ukraine is a mid-sized country with a recent history of very high inflation, it will do that within constraints imposed by external expectations which are sadly more constraining on Ukraine than exist, for instance, for the US or Japan.

On Why Strong Anti-Corruption Institutions Are Crucial for Economy

It is absolutely important to have clear disciplined frameworks for macroeconomy, and strong anti-corruption and other institutions in the microeconomy.

Part of my book points out that many successful economies have diverged from the classic free market sound-money model. So, if you look at Japan or Korea in their most rapid growth phrase, they were allocating capital in a way which was not an entirely free-market approach. They were favoring exporters over property development, backing particular technology developments. So, they were breaking the free market model of a completely free market approach to capital allocation on the micro-side.

On the macro-side they were sometimes having the central bank directly fund the banks to lend in a way which broke modern taboos of absolutely sound monetary approach and a complete unwillingness of the central bank to directly fund lending or to fund the government.

But what is interesting is that all of that depended on a certain amount of credibility, and that in each case there are other institutions which diverged from the classical free-market-sound-money model and were a disaster.

As I point out in chapter Seven, Japan and Korea deliberately identified bits of their economy which they wanted to develop – particular sectors particular industries – and they did it very effectively.

And if you go to the Philippines in the 1970s’ and 80’s, technically it did precisely the same but the vast majority of the money just ended up in corrupt projects which were run by president Marcos's cronies.

So, it tells you that what matters, is not just the theory, the philosophy but the actual execution. You can execute micro industrial policies which try to favor good sectors of the economy and you can get it right like Korea and Japan, if you have strong institutions. But if you have a high level of corruption like the Philippines had, you can technically do exactly the same stuff but you will produce a misallocation of capital not a favorable one.

And similarly, on the macro economy.

It's absolutely clear that many countries today are diverging from the absolute taboo against monetary finance. Let's be clear, what is happening in the US and even, to a degree, in the Eurozone? The central bank, by buying government bonds, is lubricating higher fiscal deficits that would otherwise exist. So, that is a breach of the taboo.

But we have other breaches of the taboo – in Argentina, in Venezuela, in Zimbabwe – which have clearly led to hyperinflation; and so, on the macro side as well, the issue is can you create strong enough institutions that you can diverge from the absolute taboos without overdoing it or without the market believing that you would overdo it.

So, it is always a matter of the strength of the institutions and the strength of the disciplines are vital to one's ability to diverge from the neoliberal orthodoxy. If the neoliberal orthodoxy is complete free markets and a complete, and utter, and always separation of the central bank from the finance ministry, in order to diverge from that you need good institutions on the micro-side to diverge from that in an effective fashion. And you need a trust in the disciplines on the macro-side to diverge from that, as well.

So, I think that issue of strength of institutions is really fundamental.

On Cooperation with the IMF

In your interface with the IMF, other international potential funders, there is this link made between the strength of anti-corruption and other forms of institutional strength and the macroeconomic disciplines. And in a sense that is bound to be the case because what I’m suggesting is that optimal policy probably requires a greater degree of macroeconomic flexibility than the extreme orthodoxy of the past in order to enable the sort of development policies that we saw successfully applied in some other countries.

The East Asian countries are always interesting ones to refer to. Japan and Taiwan used a greater degree of macroeconomic flexibility than the IMF would typically impose today. They used it successfully but the IMF and others are worried that if they don't impose macroeconomic discipline, the money will be spent in a corrupt fashion. So, they make that link and as I said, if you were to look at the experience of Indonesia or the Philippines, you would think they have a justified story because their external finance ended up in terribly wasteful projects, in a way that it didn't in Korea and Japan. So, I think you can see that from an international financial institution. This feels like a logical link but one has to try to find a way.

Whereby Ukraine can convince the international funders that it is putting in place the strong anti-corruption mechanisms, it can have the degrees of freedom to use greater flexibility.

I was thinking about the issue of localization of government procurement and the issue which then gets us to the issue of total free trade, because this is another area where there has been a neoliberal ideology which is not in line with the pattern of successful rapid economic growth developments that we've seen in the past.

The neoliberal ideology asserts that total free markets and total free trade, including no preferences for local procurement, are the way to have efficiency and, therefore, development. But if you actually look at Korea and Japan, they developed initially behind high tariff barriers. Indeed, that was also true of Germany in the late 19th century – the great period of German economic growth had tariff barriers, as indeed, America’s economic growth in the 19th century had large tariff barriers. And if you go back to the great American economic theorist and first Treasury Secretary Alexander Hamilton, his philosophy for the development of America was absolutely not a total free trade model. So, the fact is that a lot of development has had to involve a preference for local development in some way which breaks from the free market model.

And it's quite interesting to look at the UK now. The UK which has been in the past an absolute sort of extremist in the free trade model.

We are now about to leave the European Union. The government now has – and I strongly support this – some very strong green objectives to drive the development of our amazing offshore wind resource in the North Sea, which is one of our great resources, in order to decarbonize our economy. Our Prime Minister – and I encouraged him to do this – has made a clear quantitative commitment that we will build 40 gigawatts of offshore wind by 2030. That is quite interesting, because a government making a quantitative target for a particular technology which is quite a big divergence from neoliberal theory.

But the government is also trying to think about what does it do to make sure that there is as much local content as possible in the supply chain to that offshore industry. And it will use some categories of subsidies and assistance to try to build a local supply chain, to develop that offshore wind development rather than leaving it to a completely free market. So, the UK government, a conservative market-oriented government, is now talking the language of some quantitative targets and some local supply chain developments which requires some degree of local preference.

If I were you, I would argue for some categories of local preference within government procurement. I think, those are easier forms of divergence from free trade to justify the large tariffs which can be a major impediment to efficiency. But if you are going to argue for that sort of localization in government procurement, you will absolutely have to convince the IMF and others that you have very tight anti-corruption mechanisms. Because they will simply see a trade-off.

I mean, the better you can make your anti-corruption mechanisms, the more likely you will be able to use the tool of some government procurement local preference as a useful way of encouraging the development of Ukrainian business – including small and medium business – across many sectors of the economy.

So, I think we can see that there is necessarily a link between the strength of the institutions and the anti-corruption institutions – and the trust in those – and the degrees of freedom to use some of those forms of subsidy or local preference which I think will be required to help support the development of the Ukrainian economy.

Answers to Questions

Tetiana Bohdan:

Do you consider a full liberalization of cross-border capital force to be appropriate for a country like Ukraine that has weak financial system and tremendous domestic investment need

A. T.:

Thank you! What a good question! And a difficult one.

What is interesting on the background of this is to go back to the Asian financial crisis of 1997 to 1998. Before that crisis there was a very strong tendency of the IMF to argue for complete and rapid liberalization of capital accounts, both long term and short term.

I think, it was at the Hong Kong meeting of the IMF in 1997 or 1998 that there was actually a suggestion of writing a short-term capital market liberalization into the articles of association of the IMF. And that was a sort of high point of the ideology of short-term capital liberalization. Just at that point we were realizing some of the disadvantages of it because what we saw, for instance, in Thailand was the potentially unstabilizing impact of short-term capital flows. We saw huge flows which rushed into those markets and drove up local asset prices. We saw also very dangerous forms of a currency mismatch in the balance sheets of the banks, the banks which borrowed in foreign currency, in dollars to lend money to real estate developments whose denomination ultimately was going to be in Thai Baht – in the local currency.

And when that process of inward financial flow came to an end and reversed dramatically in the course of 1996 through to 1998, this of course produced bank bankruptcies because they were stuck with collapsing prices of real estate loans in the local currency against foreign currency liabilities.

And so out of what happened in Asia, I think a far more nuanced attitude to short-term capital flow developed and was right to develop. And even the IMF over the years has been more open to the idea that we shouldn't open capital markets immediately or in all cases.

And I refer in the book to various studies which illustrate the fact that there isn't actually much evidence of the benefit from short-term financial flows. I remember, there was a study by very good Indian economist who pointed out issues with the speed at which you can have changes in speculative flows, the difference between speculative flows and long-term flows.

So, I think, the IMF itself has now a less ideological point of view on capital market liberalization than it did 10 or 15 years ago. It has itself produced papers recognizing that there are those imperfections.

There's also very interesting writing by the French economist Hélène Rey about the nature of global financial credit cycles and the imperfections. So, I think one should have a non-ideological approach.

What I don't know is the precise application of this to the current Ukrainian environment.

What I would watch like an absolute hawk, I would watch very carefully, as a central bank and a financial regulator, is the emergence of any forms of dangerous currency mismatch. If you start seeing people in Ukraine taking out mortgages denominated in euros or dollars, because of low interest rates, be incredibly wary of that! Because that is a financial mismatch which may look good for a period of time but if you ever get, or need to get, a significant depreciation of the Ukrainian currency that will just create a disaster.

We actually saw similar forms of mismatch in Hungary and various other countries. So, be very careful of whether either corporates or residential consumers are taking on inappropriate currency mismatches.

But my overall point of view would be to be very wary of flows of short-term money if that ever drove up the value of the currency. In the past, countries like Brazil and Chile have struggled with periods of optimism and enthusiasm about their economies generating harmful appreciations of the local currency which have undermined the competitiveness of the local industry. And then, suddenly, the confidence has reversed. And, of course, once you've lost your local industry, you can't rapidly bring it back.

So, if you look like a country like Chile, which has very large copper reserves, and where therefore there was always a danger that the currency would fluctuate with the copper price in a very unhelpful fashion, they have over the years put in place a series of constraints against inward financial flows in order to damp that oscillation in the currency.

So, I’m sorry I can't go through the details of everything as it relates to the current Ukrainian situation, but certainly the experience from around the world argues for a non-ideological and careful approach to the liberalisation of short-term capital flows.

Vitaly Lomakovich:

The inflation rate in Ukrainian economy was less than 3% during the 10 months of 2020. The nominal interest rate set by the National Bank is 6% per annum. Among the economists, there is a discussion about the NBU running super soft monetary policy, setting nominal interest as low as 6% with 3% of annual inflation. Besides, for 3 years, the NBU has not been buying government domestic bonds in the secondary market – which is, in fact, allowed by the law.

So, what is your consideration on whether the NBU’s monetary policy being soft, indeed? And do you consider making every effort to maintain low inflation rate, instead of cushioning pandemic shock and stimulating economic grow, viable?

A. T.:

It's difficult for me to comment in detail on the Ukrainian National Bank policy without going into the real details, but as you have described it, it doesn't sound like a super soft monetary policy. If inflation is at three percent and the nominal interest rate is at six percent – which gives one a real interest rate of three percent, as described – that sounds a reasonably disciplined approach. And, of course, the central bank has not been doing the quantitative easing operations that the central banks in the major economies of the world have been doing. And indeed, which some emerging developing economies are doing.

There's an interesting IMF paper out recently, looking at the role of quantitative easing even in developing economies. So, it sounds to me like the central bank – and I’m sure they would say that this has been necessary to squeeze uh inflationary expectations out of the system and to put the period of high inflation uh behind them – that they've been reasonably successful in that. But, of course, one of the benefits of that credibility could be to give a greater uh degree of freedom.

Now, I think one of the really interesting issues for a country like Ukraine is what is the optimal inflation rate. Is it as low as the 2% or lower, that we see in Japan or in the Eurozone?

What we've seen in many developing economies in their periods of rapid growth – economies which are trying to grow to the top levels of GDP per capita – is that they typically have not had inflation rates literally at two percent. Successful ones have often had inflation rates at the sort of 5–10% level. For instance, if you look at Turkey over the years, it has had reasonably rapid growth without hyperinflation but without super low inflation.

This is the debate that is held in economics – what is the point at which a somewhat higher rate of inflation turns into inflationary expectations and then inflation runs out of control.

Whereas some economies have managed to run with inflation rates of five or ten percent over the years, others have found that once you get to that level, it generates expectations which then multiply. But it sounds like Ukraine is well away from that. It has ended up with a quite a low rate of inflation for the current situation. I think, three percent is a certainly acceptable level and I wouldn't think there's a high priority of squeezing it down.

So, there is an issue of whether if it is down at three percent and nominal interest rate is six percent, is there now enough credibility in the system to allow some more freedom at the margin, on the instruments and mechanisms which are required to support investment? And there may well be!

But certainly, hearing your figures of six percent nominal rates and an inflation rate of three percent, I wouldn't automatically describe that as being an ultra-soft monetary policy. That seems a reasonably robust monetary policy.

Volodymyr Panchenko:

My question is about institutions… Special ones, in the form of development banks or a funds to use money… Europe now has a plan of a decade of “helicopter money”. So, Ukraine will not be able to use this possibility in green deals.

You have told UK having 40 gigawatts potential, offshore. Ukraine has 16 gigawatts onshore wind power generation. So, not using the opportunity of green deal would be a great lost for Ukraine.

A. T.:

I think, this issue of development banks is a really important and interesting one. Because if you go back to the basic theory of the way that we create nominal demand, which can either go into consumption or into real estate speculation, or into industrial development, that nominal demand can come from a number of different sources. It can come from private banks creating credit and money.

But we know empirically that private banks left to themselves have an inherent tendency to fund a lot of that towards real estate construction and real estate speculation. So, you have to think about whether you can get all of your development from private bank credit creation.

Another way to create new demand is for governments to run fiscal deficits and to directly fund investment. And under some circumstances, if we have very low rates of inflation and interest rates are very low, that can be supported by central bank forms of quantitative easing and monetary finance. But that has the disadvantage that if there isn’t discipline, it can lead to hyperinflation.

And that is why my book was called “Between Debt and the Devil” – between the disadvantages of private debt, which can be head towards speculation in real estate, and the devil which in this case is a reference to the figure Mephistopheles from Goethe's “Faust” who tempts the emperor to print so much money that there might be hyperinflation. That is why the book is called it.

There are disadvantages of the state creating money and there are disadvantages of purely private banks creating money. Within those two disadvantages, development banks are a very interesting alternative.

What development banks do, is you create something which is one step removed from the government and the political process and therefore you can contain or limit the danger of overcreating money. Because you create a structure of how much money it can create given its capital. It’s disciplined. But you are also able to say to it, “Your mandate is only to lend money for industrial development. You're not allowed to go and start lending money for residential mortgages or real estate development, or real estate speculation, or whatever.”

That is the basic theory of development banks. And I think, they are very important institutions.

We in the UK are now going to set up a new national investment bank to focus on green investment to help drive the development of a green investment in the UK. The European Investment Bank plays a very important role, the EBRD plays a very important role.

So, it may well be, I would have thought, that in the Ukrainian situation, the way to choose the optimal path between the dangers of pure private debt and the dangers if you get it wrong in discipline in the budget, is to use a national development bank with a clear mandate and clear institutional disciplines. In order to drive increased funding of industrial development and, in particular, green development.

So, certainly, I think that is a very interesting area to explore.

Oleksandr Vashchyshyn:

Can you comment on the rising power of the Modern Money Theory which is available in the English-speaking world very much, like in the US and the UK as well?

A. T.:

The Modern Monetary Theory is, in a sense, not modern. It is exactly what I refer to in my book. It is the possibility, under some circumstances, of monetary finance.

It is one of the ironies that one of the clearest statements of the possibility of monetary finance was made by Milton Friedman in an article, which I refer to in the book, in 1948. There he said, “Why do we bother with all this complicated rigmarole of central banks and finance ministries, and interest rates, etc.

If we want to grow the economy, why doesn't the fiscal authority directly issue money? If it wants to grow nominal GDP by, say, four percent per annum, maybe with two percent real growth and two percent inflation. And therefore, probably, if we assume that there's got to be a stable relationship of money stock to money income over time – a stable velocity of circulation of money.

If that ratio is one to one, why doesn't it each year run a fiscal deficit of four percent of GDP all of which is financed by printing money? Then the money stock will grow by four percent, nominal GDP will grow by four percent, and it will all be completely stable.

And that that isn't some crazy socialist, some ultra-Keynesian. That is Milton Friedman, 1948. And the whole of the essence of Monetary Theory is in, paradoxically, Milton Friedman.

In a sense, what my book was saying, without calling it Modern Monetary Theory, is that there are some circumstances where you can do that. But what I then go on to say, and I said this in a paper that I delivered to the IMF what's called the Jacques Polak Monetary Conference in November 2015. I presented a paper called “The Case for Monetary Finance – An Essential Political Issue”.

What I meant by that, is that the basic theory that you can, under some circumstances, do monetary finance, and that under some circumstances it will be beneficial and help stimulate the economy is absolutely clear and relatively easy to describe. And it is described by Milton Friedman.

But the difficult issues are the political issues. It's how do you accept that we can do monetary finance, while maintaining discipline about not doing monetary finance to excess. If a small amount of monetary finance would be good, how do you make sure that you can tell politicians that, without politicians believing that they can then do limitless amounts of monetary finance. That's why it's an essentially political issue.

In a lot of countries, the resolution of this political issue was to create a taboo. It was, to say, “we find it so difficult institutionally to stop using monetary finance to excess, that we will create a taboo, whereby we must never use it.

It's almost as if some people who smoke have the discipline to stop smoking 20 cigarettes a day. But once a month to smoke a nice cigar because they like smoking a nice cigar. But other people find that if they want to stop smoking to excess, the only way is to convince themselves that they must never ever in their life touch another cigarette. Even though one cigarette wouldn't give you lung cancer.

And so, sometimes, in life where there is a danger that something is addictive, we find that the only way to break the addiction is to have a total taboo against it.

But modern monetary theory points out that there are some circumstances where monetary finance might be beneficial. I think what I disagree with some of the people who support modern monetary financing. I find that they fail then to engage with the political question of how you discipline it right, how you use it in a disciplined fashion. And I think, there is a legitimate fear that some of the proponents of the monetary theory simply think that they have discovered a limitless and magic money tree that you can use limitlessly.

The crucial point about modern monetary theory is you can use monetary finance in a disciplined fashion, in a small amount in specific circumstances, in a beneficial effect. But if you use it in excess, you will destroy its benefits and produce disadvantages. And so, you need a political and institutional theory of how to use it.

Well, and the political and institutional theory is actually far more difficult than the pure economic theory which tells you that it is that it is possible under some circumstances.

Oleksii Zhmerenets`kyy:

Would you, please, recommend other books, by your colleagues, which are worthy of translating into Ukrainian and useful to read for the Ukrainian politicians willing to change and improve the financial system of Ukraine?

A. T.:

In the book, there is a set of references which are often quite classic references, in the sense of they are books and articles written seventy or eighty, or hundred or more years ago.

Because what I actually found when I looked at these issues, was that a lot of modern macroeconomics had got so wrapped up in sophisticated mathematics and models that it was no longer thinking clearly about the essential nature of credit and money.

So, some of the things that I found most useful to read was a book by a Swedish economist called Knut Vicksell, “Interest and Prices”, written in 1904. Because he thought about where did money come from.

And I also read, and I reference, articles both by John Maynard Keynes “The Treatise on Money” and Friedrich von Hayek’s “The Theory of Money and Credit”. And what is interesting in that is that most people think of John Maynard Keynes and Fredrich von Hayek as of polar opposites in the debate about economic theory. But I actually found that they had thought more deeply about the nature of credit and money than most modern macroeconomists.

In the final chapter of the book, the epilogue, I reference an article written in 2009 by Professor Villem Buiter, a Dutch economist who was also on the Monetary Policy Committee of the Bank of England and he called his article “The Unfortunate Uselessness of Most 'State of the Art' Academic Monetary Economics”. And his argument was that most modern analysis had just got so wrapped up in the maths that we could no longer see things clearly.

So, yes, there are particular articles in the book and I would encourage you to have a look at Vicksell, at Keynes, at Hayek, at early Friedman.

But also have a look at Hyman Minsky's writings on the fundamental instability of private credit.

I think, a fundamental and the other big thing that we did before 2008, is we’ve created this absolute taboo against governments creating too much debt and central banks financing government debt. That was the thing you weren't allowed to do at all. And we’ve completely ignored the fact that the private debt creation process could create problems.

And, in fact, the 2008 crisis was a crisis entirely to do with things that went wrong in the private sector of the economy. It wasn't a crisis at all driven by irresponsible governments borrowing too much or central banks allowing inflation to get out of control. It was a problem entirely on the private banking side of the economy.

And the person who had written about that, but who had been almost entirely ignored, was Hyman Minsky.

Viktor Proshkin:

How can Ukraine become more attractive for investors?

A. T.:

I don't think I know enough about Ukraine to really advise that. I think, in order to do that, I will have to visit Ukraine. So, I hope, when this COVID crisis is over, I will find that opportunity.

Obviously, Ukraine has very important resources – agricultural, mineral. But we all know that in economies which grow to a high standard of living, the natural resources are not the key thing. It's about the human resources, it's about the capabilities, the entrepreneurship, the technologies, etc.

I think, the issue of whether you can develop a green economy is an important one, because that is a really important future step forward. And I think, what I understand, is that Ukraine starts with quite a high level of human capital – in a technical, engineering, scientific sense. Some very strong capabilities there which it has to build on.

I really have to avoid that question because it does require an understanding of what the sources of industrial competitive advantage are, which I currently lack.